Format of a Typical Residential Appraisal by Michael Kavluk

The Inspection:

The appraisal begins with a property inspection, usually taking up to 45 minutes depending on the size of the home or condo. I'll closely examine the structure and systems, noting any upgrades or issues to understand the property's overall condition.

Research:

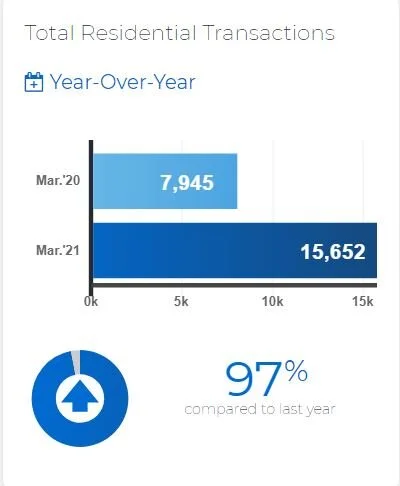

I analyze local market conditions, focusing on housing trends in the Greater Toronto Area (GTA) and the specific neighborhood of the property. I review property sales from the past several years and select the most similar ones for comparison. As a member of the Toronto Real Estate Board, I have access to comprehensive sales data dating back to the 1970’s.Key Data Points Considered:

Location

Type / Style / Above Ground Sq. ‘ / Lot Size / Improvements / Deficiencies

Current Sale Price Range in the Area

Number of Current Listings

Asking Price Range of Current Listings

Average Days on Market for Current Listings

General and Local Market Trends

Adjusted Square Foot Values

Comparison with the most similar property sales.

These adjustments are described and accounted for in the report in the Direct Sales Comparison Approach to value.

Rationale:

Often, a fuller narrative explanation of the individual appraisal process is required. This is an opportunity to discuss how some adjustments were approached and how specific conclusions were reached.

Conclusion:

The adjustments are calculated, and the general value range of the subject property is ascertained. Greatest weighting is given to the comparable(s) requiring the least net and gross adjustments. After careful consideration and a "common sense" review, a final value is submitted to the client in the appraisal report.

Careful thought is given to the results of the research. The report is put aside for a day. Conclusions are carefully considered.

The Report:

You will receive a fully descriptive original appraisal report which includes selected comparables, a narrative rationale, supporting documents, and photographs.

Delivery of Report:

The report is carefully reviewed before being released to the client, within 3-5 business days following the inspection. A PDF version can be e-mailed immediately, followed by a bound, hard copy report, if requested.

Overview:

These appraisals show the property's market value, either now or in the past. My main goal is to provide a clear and fair market value based on thorough research and current market conditions. I will not discuss market value until the appraisal is finished.

Bank appraisals can be biased, as they aim to protect the lender's interests. The client here is the bank, not the homeowner. Banks often order appraisals for recently sold properties or refinancings, so the appraiser usually knows the expected value already. This raises the question of whether the report reflects fair market value or just the bank's criteria.

I evaluate properties impartially, relying on comprehensive market research without prior influences. Each report is original and avoids recycled data, using no templates or outside interests. My appraisals focus on historical research, current market trends, and the specific qualities of the property being evaluated.